Meals Tax

A possible meals tax could go to voters via referendum in Nov. 8, 2016 general election.

Under state law, the county would keep 100 percent of revenue generated by a meals tax.

Counties can impose a meals tax if voters approve via referendum. If voters approve a meals tax, implementation could occur by July 1, 2017.

Meals Tax History By the Numbers

1992

A county meals tax was defeated by referendum in April 1992.

102,000

Voters cast votes in the 1992 referendum, which was approximately 25 percent of registered voters.

58

Percent of the voters voted against the potential meals tax in 1992.

2004

Legislation to exempt Fairfax County from the voter referendum requirement on a meals tax passed the Virginia Senate but failed to pass the house.

2008

Loudoun County held a referendum for a meals tax in November 2008 to fund new school construction, but it failed by a 70-30 percent vote.

2013

Henrico and Middlesex counties approved meals tax referendums. A similar effort in Chesterfield failed to pass.

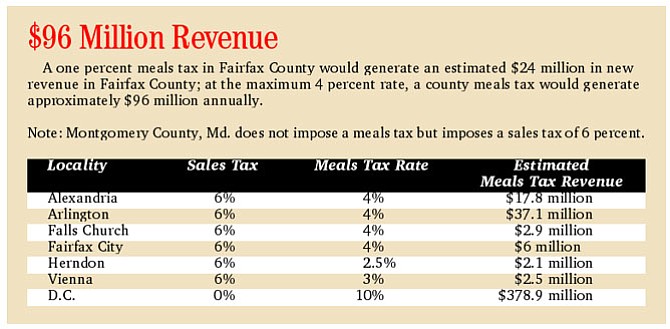

Correction: The chart on the meals tax published in the May 17 and May 24 editions of the Connection should have said that Herndon imposes a 2.5 percent meals tax and Vienna imposes a 3 percent meals tax rate.

A majority of The Fairfax County Board of Supervisors voiced support last week for including a Meals Tax Referendum as part of the 2016 General Election. They hope that a meals tax could provide additional revenue to support schools, without putting additional burden on homeowners with the property tax.

The debate and final vote is scheduled for the Board’s June 7 session. Then it could be up to voters.

“If this is approved, it will be new revenue. It’s diversified revenue,” said Lee District Supervisor Jeff McKay. “I want to put it on the ballot. Ask the voters.”

“We have an opportunity here,” said Mount Vernon Supervisor Dan Storck.

“This is a tool used by cities and towns within and adjacent to Fairfax County,” said Hunter Mill Supervisor Catherine Hudgins. “It is time for Fairfax County to join these counties and begin diversifying our revenue sources.”

“We have a coalition of groups to advocate for the meals tax,” said Chairman Sharon Bulova. Bulova and Dranesville Supervisor John W. Foust advocated designating 80 percent of the money collected in a meals tax to Fairfax County Public Schools, and 20 percent to capital improvement projects.

In fact, the Board’s budget committee approved by majority vote a ballot question based on a 70-30 split.

“I think this is likely to be the ballot question,” said Budget Committee chairman Jeff McKay.

School advocates are front and center in supporting a meals tax, believing it will help bridge funding shortfalls.

“The community is ready to support this,” said Pat Hynes, chairman of the Fairfax County school board, and the representative from Hunter Mill.

“Referendums focused on schools and capital improvements prove the ones most likely to pass,” Hynes said, citing recent referenda on meals tax elsewhere in Virginia.

NOT SO FAST. Springfield Supervisor Pat Herrity ensured another point of view.

“There is an advocacy group forming on the other side, chambers and restaurants,” said Herrity, pointing out that it is actually in addition to a six percent sales tax already collected on meals.

“Certainly from the chamber’s point of view, we don’t want to see any tax that singles out any industry,” said Jim Corcoran, president of the Northern Virginia Chamber of Commerce.

A potential four percent meals tax could create $96 million annually in additional revenue for the county, more than $20 million from non-county residents.

“Let’s look at the equation on both sides,” said Corcoran.

“It does not send the right message to businesses,” many who make Fairfax County their headquarters, he said. “We have developed a business-friendly environment, internationally.”

A “domino effect” could quickly erase revenue generated by the meals in loss of business and tourism, said Corcoran.

“The average taxpayer is not going to get tax relief. We’re hearing our real estate taxes are getting higher and higher. This isn’t going to alleviate that,” said Providence District Supervisor Linda Smyth.

“If people think the meals tax is coming on top of an increasing property tax, it will fail. Maybe it should fail,” said Braddock Supervisor John Cook.

The Greater Reston Chamber, according to its CEO and President Mark S. Ingrao, “has a long held position by our members of opposing single-industry taxes particularly if they do not benefit the industry being taxed.”

Ingrao said the Reston Chamber advocated for additional funding for education at this year’s General Assembly by supporting the restoration of Cost-of-Compete-Adjustment (COCA). “COCA recognizes that the costs of hiring and retaining teachers in northern Virginia is more expensive than in other parts of the state and the Chamber was part of a partnership that secured $34.4 million this year,” he said.

McLEAN CITIZENS ASSOCIATION supports looking at alternative revenue sources including a possible meals tax. MCA passed a resolution in March urging the Board of Supervisors to look at “other opportunities for revenue improvement.”

Other [possible] opportunities for revenue improvement: higher hotel occupancy taxes paid by hotel patrons, a higher cigarette tax consistent with the practice of surrounding localities, an admissions tax to places of amusement or entertainment, the possibility of a meals tax, and a re-evaluation of permit and user fees, set consistently to fully recover costs.”

— McLean Citizens Association Resolution

“So we get to share the fun with others,” said Dale Stein, MCA’s chairman of the budget committee. “Why does everything need to “be on the back of the real estate tax,” he said.

David Edelman, of the The Fairfax County Council of PTA’s, said, “Our main concern is getting sustainable funding for schools and unfortunately there aren’t many options available to us.”

“We’ll definitely get the message out there if the Board of Supervisors puts it on the ballot,” he said.

THE BOARD of Supervisors would adopt a Resolution directing the County Attorney to file a petition with the Circuit Court by July 26.

The Board of Supervisors will meet on June 7 and instruct County staff to prepare documentation on the impact of the meals tax on the county; the Board could vote officially to prove or not approve the ballot question.

In 2008, Loudoun County held a referendum for a meals tax in November 2008 to fund new school construction, but it failed by a 70-30 percent vote.

In 2013, Henrico and Middlesex counties approved meals tax referendums. A similar effort in Chesterfield failed to pass.

“The meals tax ballot questions that have been approved are the ones that tell you where the money is going, and where it will go to schools and capital improvements,” said McKay.

The Town of Herndon passed its meals tax in 2003.

“We estimated $900,000, and it generated $900,279. Not bad for estimating something right out of the chute,” said Mary Tuohy, the Town’s director of finance.

Herndon Town Council increased the rate from 1.5 to 2.5 percent in 2011, and directed funding to major Herndon downtown infrastructure projects. Herndon also uses the meals tax to promote its restaurants and dineONHerndon campaign, according to Town’s spokesman Anne Curtis.

The Town’s tax preempts a county tax, said Curtis and Tuohy, “and in fact was one of the reasons it was enacted in Herndon in the first place,” said Curtis.

If county voters approve a meals tax, implementation could occur by July 1, 2017.